We are excited to announce that this year we are partnering with Explain My Benefits, our new technology/benefit communication vendor, to guide each employee through the enrollment process, learn about the new benefits and introduce you to our new online enrollment system!!! Please take some time to review your Benefit Guide that will be distributed at each location, along with the brochures and videos on this page.

Sample Benefit Guide

Sample Benefit Guide (pdf)

For more information please see the Brochures and Videos to the right.

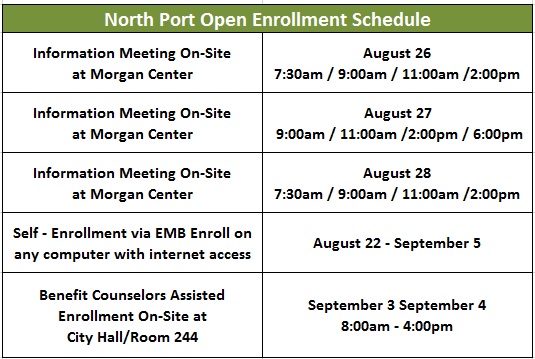

Sample Schedule

Voluntary Benefits are designed to provide additional cash flow to assist with out of pocket medical costs and other bills based on individual concerns and needs.

- OWNERSHIP – Policies are fully portable and belong to you if leave your employer

- Benefits are paid directly to you, not to a hospital or to a doctor

- Benefits are completely separate from medical insurance, are paid regardless of other coverage

- SPECIAL UNDERWRITING – (Guaranteed Acceptance) – HEALTH QUESTIONS WAIVED ON ALL PLANS!!! During your initial enrollment only!

Trustmark Universal Life with Long Term Care provides protection for you and your loved ones in the event of a untimely death. Universal Life is permanent insurance priced till age 100. It pays a higher death benefit during your working years when expenses are high and in your retirement years when financial needs are lower the long term care benefit continues to protect you. **

Trustmark Accident Insurance offsets the cost of unexpected expenses that result from accidents that occur everyday. It also features a Wellness Benefit for routine physicals and health screening tests payable for two visits per covered person, per year. **

Click Here To See How the Wellness Benefits Pays for The Accident Plan!!!

Trustmark Critical Illness/Cancer Plan can provide immediate financial relief from overwhelming expenses of a serious illness, such as a heart attack, stroke or cancer. It pays a lump-sum cash benefit when you are diagnosed with a covered illness easing your financial worries. **

LifeLock Identity Theft Protection works to help stop identity theft before it happens. As a member, if you become a victim of identity theft because of failure in their service, they will help fix it at their expense, up to $1,000,000. This benefit through your employer saves you 10-15% off the retail rate. **

** See video and brochure on the right for more details.

FORMS

*All benefits covered subject to change. This is an Employee Benefit Highlight Summary and not a contract. If you have any benefit questions, please contact Risk Management.